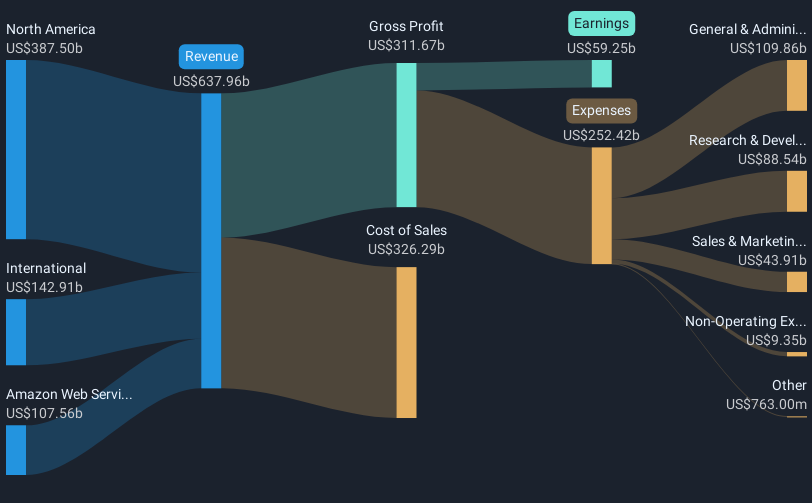

Amazon.com (AMZN) recently experienced a price move of 13% over the last quarter, amid several key developments. Notably, Amazon Business expanded its services to LPL Financial, highlighting a strategic push in the B2B procurement space. This aligns with its efforts to enhance AI-driven solutions via AWS, as seen in partnerships with DoiT and Sendbird. The company’s robust Q2 earnings report, featuring a significant revenue boost and forward-looking sales guidance, provided a supportive backdrop. Furthermore, the broader market environment, characterized by tech stock fluctuations and persistent inflation concerns, may have tempered the full impact of these positive developments.

We’ve identified 1 weakness with Amazon.com and understanding the impact should be part of your investment process.

We’ve found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The recent expansion of Amazon Business’s services to LPL Financial and partnerships to enhance AI-driven solutions via AWS underscore Amazon’s ongoing efforts to bolster its position in the B2B sector and cloud computing. These developments align with the narrative of leveraging cloud transition and AI adoption to fuel long-term growth, potentially driving future revenue and earnings upward. The company’s continued focus on enhancing its logistics and international expansion might further reinforce its performance in international markets, supporting margin improvements and earnings growth over time.

Over the past three years, Amazon’s total return reached 81.19%, reflecting significant long-term growth. Its performance over the past year has matched the broader US Multiline Retail industry. This historical performance provides a context for understanding the company’s resilience and capacity for sustained returns, even amid fluctuating macroeconomic conditions.

With a current share price of $231.60, Amazon trades at a 13% discount to the consensus analyst price target of $262.77. This gap could suggest potential upside if the company’s strategic initiatives in cloud computing, AI, and business expansion materialize as expected. Analysts forecast revenue growth of over 10% annually and an increase in profit margins in the coming years, underscoring optimism about Amazon’s ability to capitalize on evolving market trends and enhance its financial metrics. These factors contribute to shaping market expectations and guide investors’ perspectives on Amazon’s future potential.

The valuation report we’ve compiled suggests that Amazon.com’s current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link